Unlock Financial Tools, Investment Insights, And Expert Guidance – All In One Convenient App !

Visit Our ABCD Page

Health Insurance

Housing Finance

Life Insurance

Mutual Funds

Personal Insurance

SME Finance

Stock & Securities

Reasons To Get a

Home Improvement Loan

Attractive Interest Rates

Benefit from appealing interests matching home loans, a better choice than higher-interest personal loans commonly used for home renovations.Minimal Documentation

Get a loan with just a few essential documents. If you already have a home loan, the documentation is further simplified.

Quick Processing

Benefit from a fast and transparent loan processing system, ensuring a smooth and efficient experience.

No Prepayment Charges:

Enjoy the freedom to make additional payments or prepay your floating-rate home loan without incurring any prepayment charges.

Balance Transfer

Seamlessly transfer your existing home loan to ABHFL and take advantage of lower interest rates without any hassle.

Who Can Apply For Home Improvement Loan?

Find out if you are eligible for applying for a home improvement loan

Get A Home Loan In 5 Easy Steps

Interest Rates

Available

Every responsible person is beholden to buy insurance for himself and his family in today's uncertain times.

Home Improvement Loan Eligibility

Explore our hassle-free housing finance solutions, tailormade to help you build your dream home

Eligibility criteria

- Nationality Indian citizen

- Minimum age for applying 21 years

- Maximum age at loan maturity Salaried - 60 years Self-employed - 70 years

- Good credit history A CIBIL Score of 650 or new to credit

- Employment Salaried or self-employed

Fees & Charges

| TRANSACTIONS | CHARGES |

|---|---|

| Loan Processing/Administration Fee | Home Loans : Up-To 1% Of The Loan Amount Other Loans : Up-To 2% Of The Loan Amount |

| Part Payment/Pre-Closure Charges: | Floating Rate Loans Given To Individuals, Where All Applicants And Co-Applicants Are Individuals: Nil Home Loans (Other Than Floating Rate Home Loans To Individuals): 2% Of Principal Outstanding Loan Against Property & Lease Rental Discounting: 4% Of Principal Outstanding Loan Against Property Or Lease Rental Discounting (Other Than Floating Rate Loans To Individuals): 4% Of Principal Outstanding |

| Other Charges: Default Penal Interest Rate / Non Conformance With Any Covenants / Stipulated Conditions | 24% P.A. I.E. 2% Per Month |

| TRANSACTIONS | CHARGES |

|---|---|

| NACH Failure Charges | ₹750/- per instance |

| Accrued Interest |

As applicable based on actual delayed status or as communicated by the lender from time to time |

| CERSAI Charges |

When the facility amount is equal to ₹5 Lakh or lesser – ₹50 per property When the facility amount is greater than ₹5 Lakh – ₹100 per property |

| Pre-closure Quotes | ₹1,000/- per instance |

| Request for Any Copies of Any Collateral | ₹750/- per instance |

| Duplicate Statement/Repayment Schedule | ₹200/- per instance |

| TRANSACTIONS | CHARGES |

|---|---|

| Stamp Duty, Legal and other Statutory Charges, Insurance Premium, Creation Charges with ROC | As per actual, where applicable |

| TRANSACTIONS | CHARGES |

|---|---|

| Cheque Return Charges | ₹750/- per instance |

| CIBIL Report Retrieval Fee |

₹50/- per instance for Consumer and ₹500/- for Commercial CIBIL |

| Loan Re-Schedulement (at the discretion of ABHFL) Charges | 0.50% |

| NOC Issuance Charges | ₹500/- |

| Cancellation Charges (if any) | 4.00% of the loan amount disbursed |

| Swap Charges (Fixed or semi-fixed rate to floating and vice-versa) |

2% of the loan outstanding |

| Fees and Other Charges | Applicable GST @ 18% will be levied |

Disclaimer: The above charges constitute the rack rate for all customers. Actual charges for any customer, if different, will be as communicated at the time of loan sanction and disbursal and will be subject to changes from time to time.

Documents Needed

Proof of Identity and Address

Passport/ Aadhaar Card/ Voter's ID/ Driving License/ Job Card issued by NREGA/ Registration certificate/ PAN card (PAN Card only as identity proof)

Proof of Income

Latest 3 months salary slip showing all deductions and Form 16

Bank statement showing salary

Latest 6 months

Proof of Other Income:

Rental receipts or documents showing receipt of income

Property Documents:

Copy of Title documents and approved sanction plan

Proof of Identity and Address

Passport/ Aadhaar Card/ Voter's ID/ Driving License/ Job Card issued by NREGA/ Registration certificate/ PAN card (PAN Card only as identity proof)

Proof of Income

IT Returns or financial documents for the last 2 years and computation of income certified by a CA for the last 2 years

Bank statement showing salary

Latest 6 months

Proof of Other Income:

Rental receipts or documents showing receipt of income

Property Documents:

Copy of Title documents and approved sanction plan

Customer Satisfaction Stories

Don’t just take our word for it. Hear from our customers about their successful financial journey with us

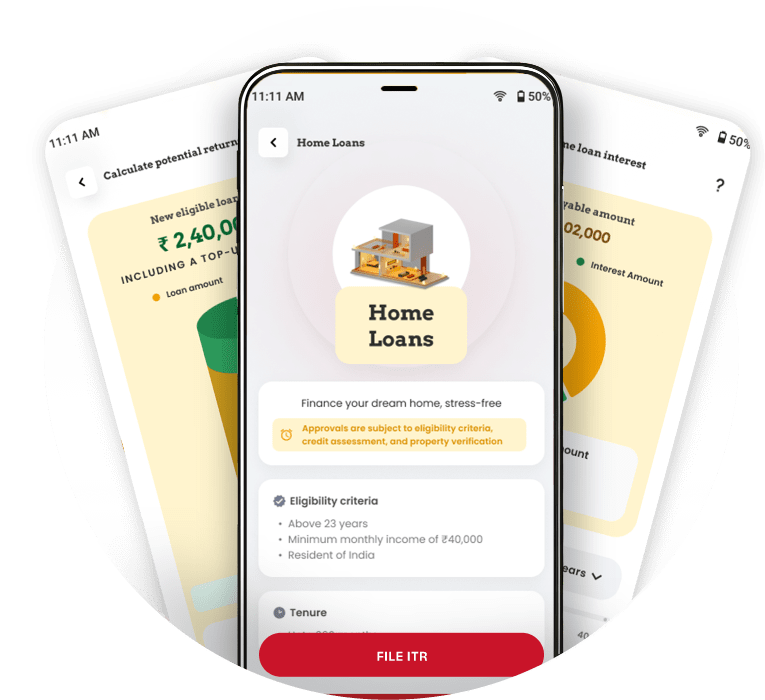

Different financial needs, different loans, one app - ABCD

Looking for a home loan? Apply online with the ABCD app and get a quick loan. Move into your dream home with a hassle-free loan process.

Scan the QR code to download our Mobile App

FAQs on

Home Improvement Loan

Home Improvement Loan

A home improvement loan is a type of financing specifically designed to help you repair, renovate, or upgrade your existing home. These loans can be used for various projects, such as repairing or replacing damaged roofs, walls, or floors, adding a new room, remodelling a kitchen or bathroom, or installing new flooring. The only limitation is that you cannot use the loan to purchase movable items such as furniture.

There are many different things you can use a home improvement loan for, including:

• Renovating your kitchen or bathroom

• Adding a new room or expanding an existing one

• Replacing your roof or windows

• Installing new flooring or appliances

• Making energy-efficient upgrades

• Fixing up your landscaping

Attractive Interest Rates: ABHFL offers competitive interest rates on home improvement loans, allowing you to finance your home improvement project without incurring excessive interest costs. These lower interest rates translate into more affordable monthly payments, making it easier to manage your finances while transforming your living space.

Loan Tenure up to 10 Years*: ABHFL provides flexible loan tenure options of up to 10 years*, giving you the freedom to spread out your repayments comfortably over a longer period. This extended tenure reduces the financial burden of your monthly EMIs, making your home improvement dreams more achievable and manageable.

Quick & Transparent Processing: ABHFL is committed to providing a quick and transparent loan approval process for your home improvement loan application. You'll receive regular updates on the progress of your application, ensuring you stay informed and confident throughout the process. The efficient processing minimizes delays and gets you the funds you need to start your home improvement project promptly.

No Prepayment Charges for Floating-Rate Home Loans Given to Individuals: ABHFL allows you to make additional payments towards your home improvement loan without incurring any prepayment charges. This flexibility empowers you to reduce your loan balance faster and save on interest costs if your financial situation improves.

Attractive Balance Transfer Option Available: If you have an existing home loan with another lender, consider transferring your balance to ABHFL and take advantage of the competitive interest rates. The balance transfer process is simple and hassle-free, allowing you to consolidate your loans and potentially save significant amounts of money over the loan term.

Doorstep Services: ABHFL understands the value of your time and convenience. That's why we offer personalised doorstep services to streamline the loan application process. Our dedicated team will guide you through every step, ensuring a smooth and stress-free experience from the comfort of your home.

The maximum loan amount for a home improvement loan will vary depending on the lender, the borrower's credit history, and the equity in their home. However, being a completely secured loan, borrowers can enjoy a higher loan-to-value ratio, that can go up to 90% of the property's value.

Interest rates for home improvement loans can vary depending on the lender, the loan amount, and the borrower's credit history. However, they are typically lower than interest rates for other types of unsecured loans, such as personal loans.

ABHFL offers low home loan interest rates starting from 8.60*% p.a. This rate of interest is applicable to Home Loans, Balance Transfer Loans, Home Improvement Loans, and Home Extensions Loans.

ABHFL offers an adjustable-rate loan also known as a floating rate loan, as well as a trufixed loan in which the interest rate on the home loan remains fixed for a specific tenure (say the first two years of the entire loan tenure) after which it converts into an adjustable-rate loan.

* Disclaimer - All loans will be at the sole discretion of ABHFL.

PLAY STORE

PLAY STORE APPSTORE

APPSTORE 1800 270 7000

1800 270 7000

Download

Download

Insurances

Insurances  INVESTMENTS

INVESTMENTS  LOANS

LOANS  PAYMENTS

PAYMENTS  QUICK SERVICES

QUICK SERVICES

HEALTH INSURANCE

HEALTH INSURANCE

Life Insurance

Life Insurance Health Insurance

Health Insurance Mutual Fund

Mutual Fund Home Finance

Home Finance Personal Finance

Personal Finance Stocks & Securities

Stocks & Securities

PLAY STORE

PLAY STORE APP STORE

APP STORE

Hyderabad, India

Hyderabad, India